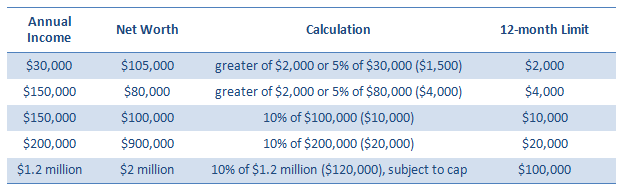

After a four year wait, as of May 16, 2016, crowdfunding portals can finally begin to operate and raise investment funds for film and other enterprises. For the first time, producers will be able to offer funders a share of the profits of a project, including low budget films. Until today, internet platforms like Kickstarter were limited to seeking donations and could only offer T-shirts and other swag to those who donated funds. The new rules make crowdfunding cheaper and easier but there is a $1 million cap on the amount that can be raised in a 12-month period. Crowdfunding refers to the process of raising money to fund a project or business through numerous small donors, often using an online platform or funding portal to solicit their investment. Because film investments are so risky, the ability to allocate that risk among many investors should increase the amount of financing available for indie films. Anyone can invest in crowdfund offerings subject to limits on the amounts invested. The entity raising funds must be American and cannot be an investment company. Funding portals are platforms that provide investors with information about investments being offered. These portals are designed to allow internet-based platforms or intermediaries to facilitate the offer and sale of securities. Portals are required to register with the Securities and Exchange Commission and become a member of the Financial Industry Regulatory Authority (FINRA). FINRA’s standards can be reviewed here. Under FINRA rules, funding portals communication cannot include in their communications any false, exaggerated, unwarranted, promissory or misleading statement or claim; nor omit any material fact or qualification which would cause the communication to be misleading. The SEC has issued an investor bulletin on Crowdfunding, portions of which are reproduced below: Can I make a crowdfunding investment? Anyone can invest in a crowdfunding securities offering. Because of the risks involved with this type of investing, however, you are limited in how much you can invest during any 12-month period in these transactions. The limitation on how much you can invest depends on your net worth and annual income. If either your annual income or your net worth is less than $100,000, then during any 12-month period, you can invest up to the greater of either $2,000 or 5% of the lesser of your annual income or net worth. If both your annual income and your net worth are equal to or more than $100,000, then during any 12-month period, you can invest up to 10% of annual income or net worth, whichever is lesser, but not to exceed $100,000. Joint calculation. You can calculate your annual income or net worth by jointly including your spouse’s income or assets. It is not necessary that property be held jointly. However, if you do calculate your income or assets jointly with your spouse, each of your crowdfunding investments together cannot exceed the limit that would apply to an individual investor at that annual income or net worth level. How do I calculate my net worth? Calculating net worth involves adding up all your assets and subtracting all your liabilities. The resulting sum is your net worth. For purposes of crowdfunding, the value of your primary residence is not included in your net worth calculation. In addition, any mortgage or other loan on your home does not count as a liability up to the fair market value of your home. If the loan is for more than the fair market value of your home (i.e., if your mortgage is underwater), then the loan amount that is over the fair market value counts as a liability under the net worth test. Further, any increase in the loan amount in the 60 days prior to your purchase of the securities (even if the loan amount doesn’t exceed the value of the residence) will count as a liability as well. The reason for this is to prevent net worth from being artificially inflated through converting home equity into cash or other assets. How do I make a crowdfunding investment? You can only invest in a crowdfunding offering through the online platform, such as a website or a mobile app, of a broker-dealer or a funding portal. Companies may not offer crowdfunding investments to you directly—they must use a broker-dealer or funding portal. The broker-dealer or funding portal—a crowdfunding intermediary—must be registered with the SEC and be a member of the Financial Industry Regulatory Authority (FINRA). You can obtain information about a broker by visiting FINRA’s BrokerCheck or calling FINRA’s toll-free BrokerCheck hotline at (800) 289-9999. You can obtain information about a funding portal by visiting the SEC’s EDGAR website. Keep in mind that you will have to open an account with the crowdfunding intermediary—the broker-dealer or funding portal—in order to make an investment and all written communications relating to your crowdfunding investment will be electronic. What should I keep in mind? Crowdfunding offers investors an opportunity to participate in an early-stage venture. However, you should be aware that early-stage investments may involve very high risks and you should research thoroughly any offering before making an investment decision. You should read and fully understand the information about the company and the risks that are disclosed to you before making any investment. The following are some risks to consider before making a crowdfunding investment:

How do I get informed? Broker-dealers and funding portals that operate crowdfunding platforms are required to offer educational materials to help investors understand this type of investing. These materials further detail the risks involved when making a crowdfunding investment. You should take advantage of this resource to educate yourself and understand the risks of making crowdfunding investments. Remember, this is your money that you are putting at risk, and you should only invest after careful consideration of the risks. Read the full Investor Bulletin. About Mark Litwak: Mark Litwak is a veteran entertainment attorney and producer’s rep based in Los Angeles, California. He is the author of six books including: Dealmaking in the Film and Television Industry, Contracts for the Film and Television Industry, and Risky Business: Financing and Distributing Independent Film. He is an adjunct professor at USC Gould School of Law and the creator of the Entertainment Law Resources (www.marklitwak.com). He can be reached at [email protected] |

Disclaimer: The information in this blog post (“post”) is provided for general informational purposes only and may not reflect the current law in your jurisdiction. No information contained in this post should be construed as legal advice from the individual author, nor is it intended to be a substitute for legal counsel on any subject matter. No reader of this post should act or refrain from acting on the basis of any information included in, or accessible through, this Post without seeking the appropriate legal or other professional advice on the particular facts and circumstances at issue from a lawyer licensed in the recipient’s state, country or other appropriate licensing jurisdiction.

For older posts, please visit The Litwak Blog.

|

Copyright 2013-2021, Mark Litwak. All Rights Reserved.│ Legal Disclaimer │ Terms of Use & Copyright │ Privacy Policy